The market is under severe pressure. What do the risk factors tell us about the next market environment?

We have clearly moved to a risk-off environment.

- But for how long?

- Is it temporary or a possible regime shift?

- What are investors thinking?

Answer: Factors help with both the here and now, and as a guidepost for portfolio positioning – real AUM growth comes from weathering storms like this. For now, the factors suggest we may have entered a longer-term period of investor caution. EDS can help our clients with this.

With EDS, you have a superior, all-encompassing view of your portfolio, accessible in one place for faster, smarter, and better decision-making. Our integrated approach to investing brings together Factor Risk, Internal Research, and Performance Attribution workflows into one seamless interface.

Background

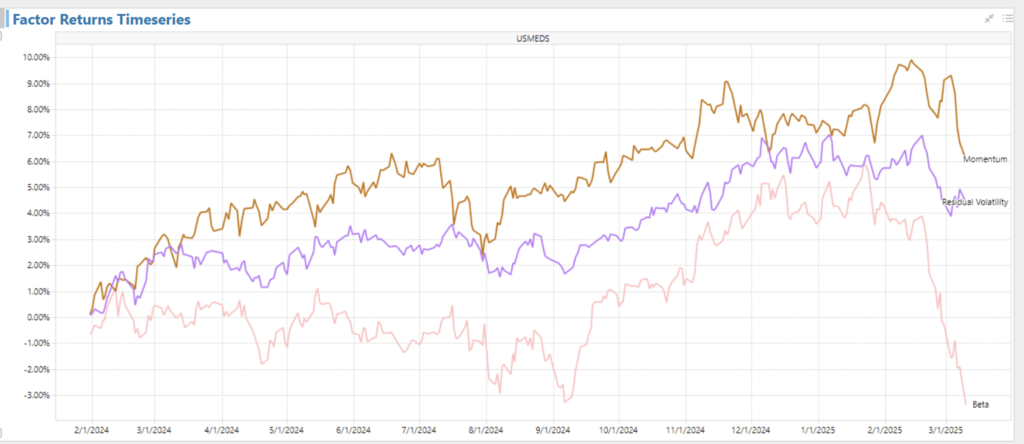

Momentum and Residual Volatility (often measures the volatility of thematic returns) has sold off and the correction in these factors after such a large 2024 run-up is normal behavior. In addition, although the Beta sell-off is expected, the drawdown is extremely vicious and overdone. In 3 weeks, we have unwound the entire Beta move from Sept-Dec 2024. (Chart 1)

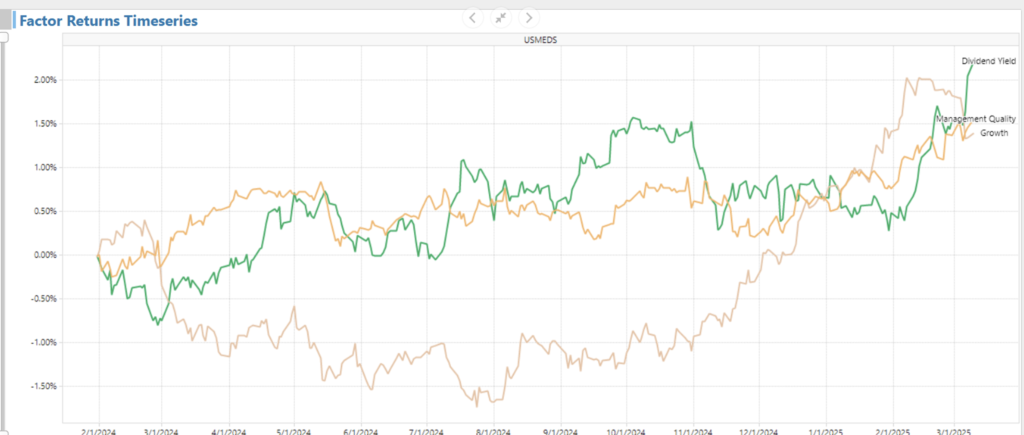

The shift, not just away from risk-off but from risk-on styles to risk-off styles, is more telling about what happens next. Investors have not just left the frothy parts of the market; they have run away to the hills in search of safety. Since the beginning of the year, they have preferred the safety of Size, Value, and Profitability. They prefer companies that pay a Dividend Yield and are well run (Management Quality). In other words, they want companies that survive a downturn. (Chart 2 & 3)

Are we close to a near term bottom? This recent drop is likely to hit a short-term bottom as the Liquidity factor has spiked down over the week (Chart 4). This is a classic signature of sell-offs as investors sell highly liquid names to meet margin call requirements.

Conclusion

Incorporating risk factors helps you understand short-term movements and possible long-term implications. With the EDS platform, portfolio managers are better positioned to make the best decisions possible, improving their ability to navigate market turbulence, manage risk, and drive long-term AUM growth.

Unlike traditional risk tools that focus solely on risk factors, EDS integrates fundamental metrics—exposures, performance, and internal research like price target scenarios—with factor analysis and expected returns to enhance decision-making.